The insurance and healthcare industries make massive amounts of money in a range of ways. Many of these are at the average consumer’s expense. The less money that’s given out through insurance, the more those companies make. Although there is one key exception to this rule, and that is misfiled claims.

A claim submitted with mistakes loses both the consumer and the insurance company money. The claim could be entirely denied, meaning there are no expenses covered by insurance. This situation is crippling for anyone dealing with a healthcare emergency. The claim could also be refiled and moved through the system. This loses the company money and time as the claim is rerouted.

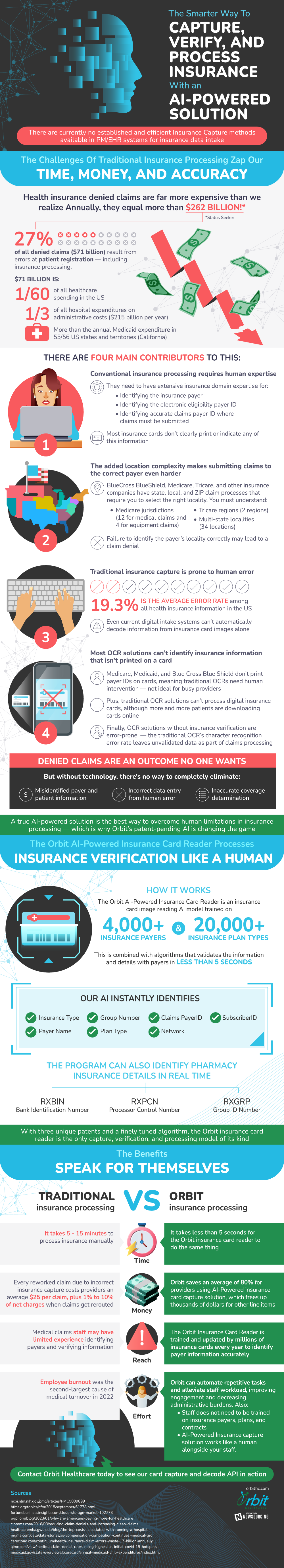

This creates a massive incentive for everyone involved to have claims be as accurate as possible. Lately, this has been accomplished through digital capture of insurance cards. Less human error majorly increases the amount of successful claims, but digital capture technology is still imperfect.

In response, AI-powered insurance card capture readers are evolving as the next step in capture technology. These are trained explicitly on insurance payers and insurance plans. What this means is that the card readers are more accurate and can even process the information themselves. This is a massive change from current card readers which simply recognize text.

These new AI card readers are the way forward for insurance. Mistakes benefit nobody, so technology that reduces mistakes benefits everybody.

Source: OrbitHC